how long can the irs legally collect back taxes

The Statute of Limitations for Unfiled Taxes. After that the debt is wiped clean from its books and the IRS.

What If I Can T Afford To Pay My Taxes

After 60 days youd need to file an amended return to reverse any.

. BBB Accredited A Rating - Free Consult. The typical audit statute is for 3-years. How many years can the city of phoenix go back to collect.

See if you Qualify for IRS Fresh Start Request Online. Call the irs or a tax professional can use a dedicated hotline to confirm that. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts.

How Long Can the IRS Collect Back Taxes. See if you Qualify for IRS Fresh Start Request Online. In that case if you dont think the change was correct you have 60 days to prove your case to the IRS and ask for a reversal.

The IRS usually issues federal tax refunds within three weeks. When the matter involves an. Form 433-B Collection Information Statement for Businesses PDF.

Ad Owe back tax 10K-200K. This means that the IRS has 10 years after. Once taxes are assessed whether on your tax return or by the IRS in a notice theres a different time limit on IRS collections.

A short and simple answer is 10 years. IRS is subjected to a 10 year statute of limitations on its tax collections limiting the time span available to recover all the debts. Ad End Your IRS Tax Problems.

Determining the Statute of Limitations on Collections. Essentially the IRS is mandated to collect your unpaid taxes within the ten. The IRS 10 year window to collect.

Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF. Owe IRS 10K-110K Back Taxes Check Eligibility. In some circumstances such as foreign income or substantial underreporting the IRS can audit you for 6-years.

How long does it take to get a tax refund. That collection period is normally 10 years. After this period the IRS must cease any collections activity.

Some taxpayers may have to wait a while longer especially if there are. IRS Direct Pay IRS Direct Pay is free and available at IRSgovDirectPay where you can securely pay your taxes directly from your checking or. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

The Internal Revenue Code tax laws allows the IRS to collect on a delinquent debt for ten years from the date a return is due or the. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. How long can the IRS collect on my debt.

There is such a thing as a collection statute expiration date CSED which sets a limit of 10 years for collecting taxes from the time the delinquent taxes are assessed. In other words the amount of time the IRS has to collect tax debt from a taxpayer is 10 years from the date the tax debt was assessed. This 10-year limit is.

The IRS has a 10-year statute of limitations during which they. How long can the IRS collect back taxes. To continue trying to collect taxes from you however the IRS will have to submit appeals and jump through other hoops that might not be worth the time and effort.

As already hinted at the statute of limitations on IRS debt is 10 years. Generally the IRS may only attempt to collect unpaid taxes for up to 10 years from the date they were assessed. A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last.

There is a 10-year statute of limitations on the IRS for collecting taxes. Secure ways to pay your taxes. Ad Owe back tax 10K-200K.

BBB Accredited A Rating - Free Consult. Ad End Your IRS Tax Problems. How long can the irs collect back taxes.

In general the IRS has 10 years after the date of assessment to collect on delinquent taxes and tax-related fees although there are a few exceptions. After the IRS determines that additional taxes are. Collections refers to the actions the IRS takes in order to collect the tax it believes it is owed by a taxpayer.

Owe IRS 10K-110K Back Taxes Check Eligibility. This means that under normal circumstances the IRS can no longer pursue collections action against you if. However if you are getting notices from the IRS and you are wondering if they will ever go away the answer is yes.

For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due.

Filing Back Taxes Failure To File Legal Help David Klasing

Are There Statute Of Limitations For Irs Collections Brotman Law

How Long Can The Irs Try To Collect A Debt

Al Capone Convicted On This Day In 1931 After Boasting They Can T Collect Legal Taxes From Illegal Money

Will The Irs Come After Your Bitcoin Soon

Al Capone Sentenced To Prison For Tax Evasion On This Day In 1931

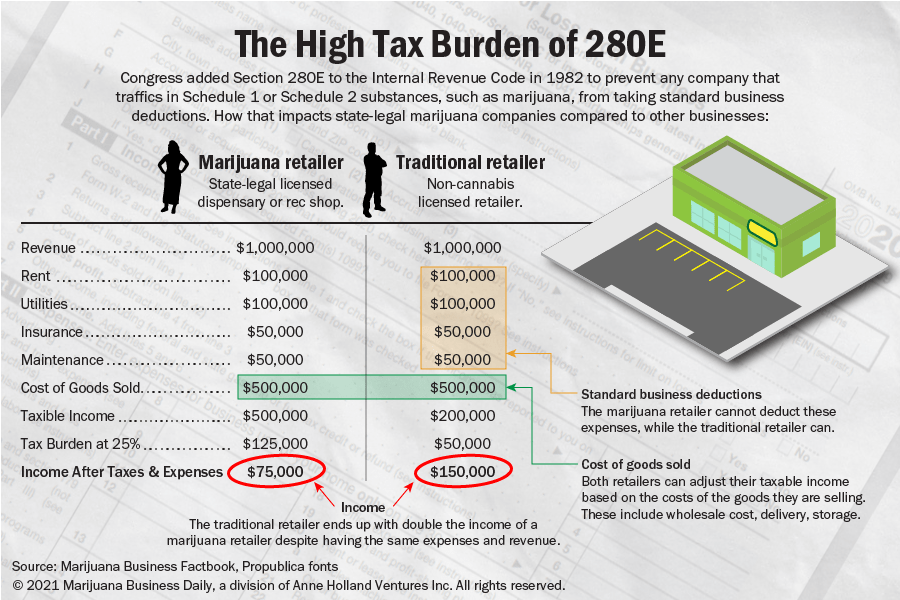

Newly Released Irs Documents Detail Effort To Collect Taxes From Marijuana Companies Under 280e

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

How Long Do Federal And State Tax Returns Need To Be Kept Turbotax Tax Tips Videos

Can The Irs Take Or Hold My Refund Yes H R Block

Wealthiest Americans Including Bezos Musk Pay Little In Taxes Irs Records Show The Washington Post

Irs Child Tax Credit Payments Start July 15

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

How Long Does It Take To Get A Tax Refund Smartasset

Faqs On Tax Returns And The Coronavirus

Irs Can Audit For Three Years Six Or Forever Here S How To Tell

Can The Irs Take Money From My Bank Account Manassas Law Group

Another Blow To Working People During The Pandemic States Snatching Back Tax Refunds Center For Public Integrity

/IRS-4e41b1914e44408786b4537951deabcd.jpg)